Pensions Dashboards – government or commercial – are being scoped to centralise pension information, with the objective of allowing individuals to review their retirement savings in one place. However, to succeed, dashboards will need accurate data. In this article, we explore what Pensions Dashboards are, when they will launch, and how – if you work in pensions administration – you can help prepare your member data for better contact verification and matching that will be needed by the Pensions Dashboards ecosystem.

Research suggests the average British worker will hold 9 jobs in their lifetime, and according to Money Marketing, an estimated 73% of people already have multiple pension pots, with 17% having lost track of one or more pensions.

Furthermore, as individuals move home, change names, or have new personal circumstances – and forget to tell their pension provider – records can quickly fall out of date, compounding the problem of keeping track of individuals and their pensions.

If you work in pensions administration, the challenge of maintaining accurate customer (or member) data isn’t anything new. However, the published deadlines for connection with the Pensions Dashboards ecosystem do bring into focus the issue of how best to maintain member data and do it with your available resources.

First, what are Pensions Dashboards?

By now, you’re likely familiar with Pensions Dashboards, but here’s a quick overview if not.

Pensions Dashboards are being planned to help individuals with multiple pension pots. The objective is for individuals to be able to sign into a single platform and view all their pensions and schemes in one place. The online dashboards will securely display information centrally, clearly showing each person’s entitlement.

A dashboard could include all private, defined benefit, defined contribution, retail or workplace pensions. Pensions Dashboards could also show any public sector and state pensions, but it is thought that pensions already in payment will not be in scope.

Who is developing Pensions Dashboards?

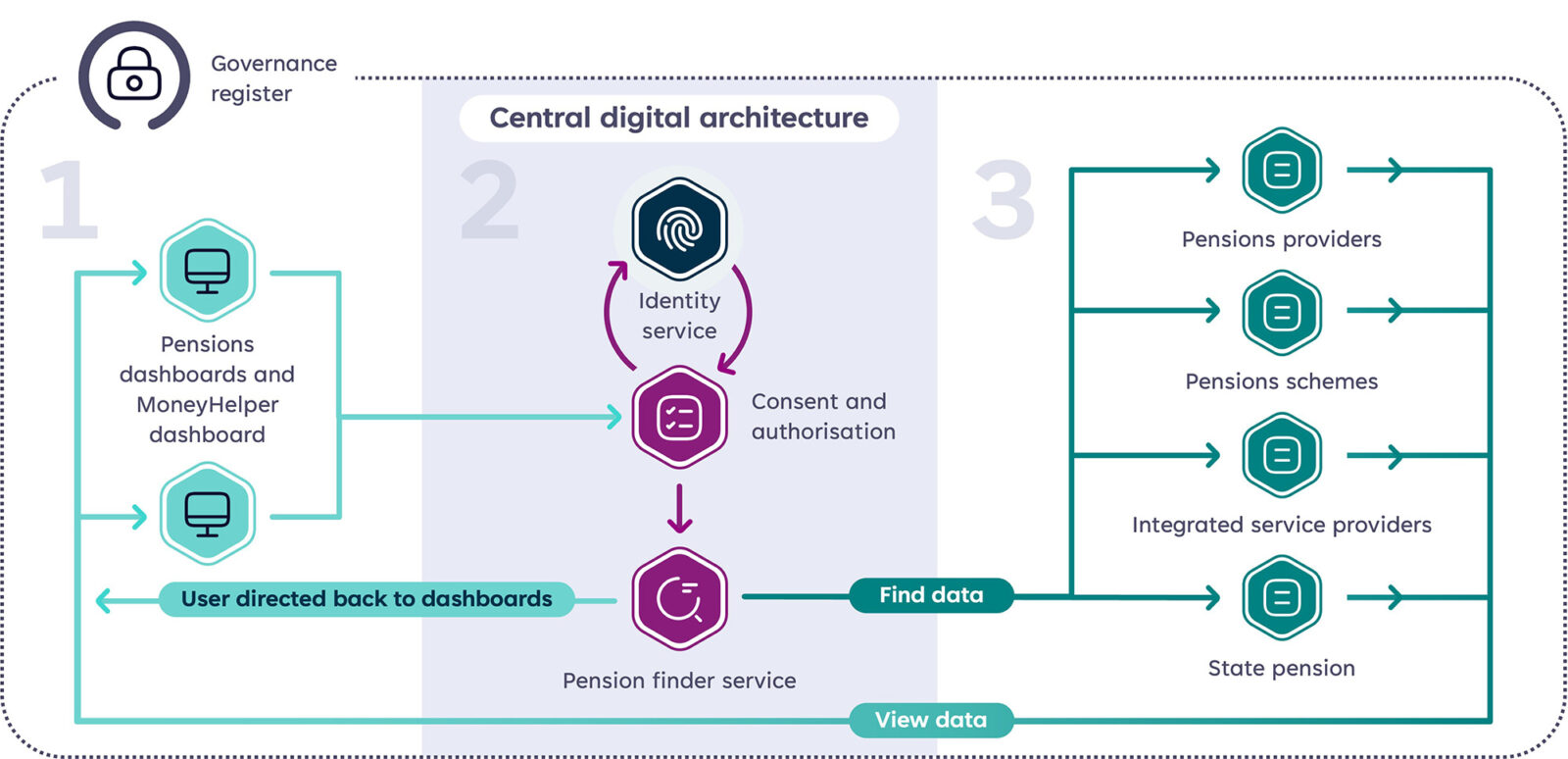

The Pensions Dashboards Programme (PDP), led by the Money and Pensions Service (MaPS), is responsible for designing and implementing the Pensions Dashboards ecosystem. This digital architecture will support elements such as connectivity and identification verification between individuals and their chosen dashboard provider.

The initiative is supported by the UK Government, industry stakeholders, and financial regulators, focusing on developing the digital ecosystem that ensures data standards work for all parties.

Over time, plans are for multiple Pensions Dashboards to be launched. The intention is for individuals to be able to use their favourite provider’s dashboard rather than a prescribed central system. The MoneyHelper dashboard from the Money and Pensions Service (MaPS) is expected to launch first, with many commercial dashboards following – of which dashboard design projects are already underway.

How will pensions dashboards work?

As the Pensions Dashboards Programme explains:

“There is no central database within the ecosystem that holds personal information supplied by users or pensions information. Instead, the ecosystem functions like a giant switchboard, connecting users with their pensions via dashboards.”

In essence, users will submit a request through the ecosystem to locate their pension information from providers.

The dashboard will conduct an identity check, and only once confirmed will it generate a unique identifier to give consent for a search. Following this search, the provider authorises the flow of information to the dashboard.

At this point, pension details are sent to the relevant dashboard for the user to see.

Why do we need pensions dashboards?

The vision of the PDP is simple:

“To enable individuals to access their pensions information online, securely and all in one place, thereby supporting better planning for retirement and growing financial wellbeing.”

— Chris Curry, Principal of the Pensions Dashboards Programme

Pensions dashboards will enable individuals to:

- Find schemes and reconnect with lost pension pots

- Understand the current value and estimated retirement income

Currently, people must contact pension tracing services if they have lost access to a pension pot.

Pensions Dashboards launch date

The exact date when individuals will be able to access their Pensions Dashboards has yet to be announced.

However, a timetable of staged dates for pension providers and schemes to connect to the Pensions Dashboards ecosystem has been published, with connections starting in early 2025. All providers are expected to be connected by 31 October 2026 at the latest. Therefore, individuals could gain access to Pensions Dashboards in late 2025 or across 2026, depending on the readiness of the ecosystem and the successful connection of pension providers.

In terms of ecosystem connectivity, providers are now moving forward with the staged timetable.

In Part 1: 30 April – 30 November 2025, large pension schemes and providers will connect to the ecosystem. Master trust schemes that provide money purchase benefits only with up to 20,000 or more members and FCA-regulated operators of a personal pension scheme, stakeholder pension scheme, a retirement annuity contract, a pension buy-out contract including a ‘section 32’ buy-out policy or an FSAVC are being required to connect first by 30 April 2025.

In Part 2: 31 January – 30 September 2026, medium schemes and providers will connect to the ecosystem. Relevant occupational pension schemes with 750-999 members and FCA-regulated operators of a personal pension scheme, stakeholder pension scheme, a retirement annuity contract, a pension buy-out contract including a ‘section 32’ buy-out policy or an FSAVC with 4999 members or below, being required to connect first by 31 January 2026.

More details on the staged timetable for connection dates are available on The Pensions Regulator website, including a tool to help your scheme check your ‘connect by’ date.

What does this mean for pension providers?

Connectivity between your pension scheme/s IT systems, and the Pensions Dashboards ecosystem is critical but beyond the scope of this article. Here, what we consider is data preparedness, an essential task given the legal duties defining data required to match members.

The Pensions Dashboard Programme Data Standards gives clear information on how you provide data, including the required type, length, and format, to help streamline connection.

If you’re in pensions administration, you will be aware that to achieve successful matching, you will need accurate data.

Preparing your member data for matching

Ensuring your data is of high quality is essential for accurately matching people with their pensions. Poor data integrity could result in incorrect matches with the wrong person or missing pension records, which may lead to enforcement action by regulatory bodies such as The Pensions Regulator or the Information Commissioner’s Office (ICO).

Key Considerations for Data Quality:

When reviewing your data, consider whether it is:

- Complete and Accurate – Ensure all necessary information is recorded and up to date

- Digitally Searchable – Data should be in a format that can be easily retrieved for dashboard purposes

Steps to Improve Data Reliability

To mitigate risks associated with poor data quality, take the following steps:

- Audit Your Data – Work with your team to assess the suitability of your data

- Develop a Data Improvement Plan – to identify gaps and implement a strategy to enhance data completeness and digitisation.

Need Help with Your Data Improvement Strategy?

At Datagraphic, we’re helping pension service providers and occupational pension scheme administrators prepare data for successful Pensions Dashboards ecosystem connectivity.

The Pensions Dashboards ecosystem will send schemes a ‘find request’ to try to match every verified potential member. The request could include a combination of data from fields such as first name, last name, date of birth, National Insurance number, previous names, addresses, email address/es, and mobile phone number/s.

Taking steps to get your data ready for these requests by auditing member contact data and filling any gaps is essential. You can download a sample Data Improvement Plan here. However, don’t worry if your resources are in short supply or if you are wondering where to start automating the process of updating members’ data; we can help.

Using Aceni, our outbound mail service, we create mailing campaigns that automatically write to members, asking them to check their contact details. Mailings can include pre-populated questionnaire forms and Business Reply Envelopes (BREs), making it easy for members to return correspondence. Plus, we can include QR codes linking to digital forms to encourage members to self-serve and update their information online, and bespoke digital imaging options that are especially useful for capturing information from overseas members to reduce postage costs.

To add value to the process and help cut postal costs, we can also capture GDPR-compliant consent data from members on mailing questionnaires, gaining their agreement to transition to digital-first communications rather than receive paper copies by post.

For any replies received, Datagraphic’s Inbound Mail team can scan forms and automatically capture physical and digital data for import into your line-of-business systems, removing timely and costly manual data entry.

Once this seamless and automated process is in place, we can then periodically repeat the data cleansing mailings to ensure your members’ data is continuously improved and accurate – which is especially important given the anticipated time gap between ecosystem connectivity and Pensions Dashboards going live for use by individuals.

One client working in a pension team recently told us that pension information can become outdated within a few years. For example, their records became incomplete as members moved house, got married, or experienced bereavement. ‘Gone away’ or returned replies to regular correspondence aren’t always updated as fast as possible which can cost the organisation wasted mail and administrative time to investigate or follow up.

To reduce and even eliminate this unnecessary expense, document automation can take the pain out of data cleansing.

Using automation to deliver communications

Using a trusted partner like Datagraphic, pensions teams can automate the production, delivery and response handling of outbound and inbound data cleansing campaigns.

Existing clients use our Aceni multichannel communications platform to send automated outbound mail, prompting members to update personal details. All responses are then quickly and accurately processed, consolidated and supplied back in a digital format to clients for import into their system/s.

Working with Datagraphic, the highest levels of data security are also assured, as we are certified to the latest ISO 27001 and Cyber Essentials Plus and fully comply with UK-GDPR.

If you would like to learn more about how Aceni – our multichannel communications software, can support you with data cleansing and response handling to improve your data quality for connectivity with the Pensions Dashboards ecosystem, please don’t hesitate to contact us.