Payroll deadlines are overwhelming, especially at a time when financial well-being is so critical. Teams don’t have the luxury of extra time for additional tasks like ad-hoc employee requests to verify employment information. However, these tasks are really important for employees when applying for credit, such as a mortgage or tenancy agreement. A delayed decision can be the difference in securing a preferable rate, which can drastically affect an individual’s financial situation.

To address this added pressure, the latest collaboration between Datagraphic and Experian automates the verification of employment and income within seconds.

The integration of Experian’s Work Report™ into the secure Epay portal effortlessly shares income and employment data – with a consumer’s consent – with credit lenders. This connected network delivers efficiency for HR teams and empowers employees to achieve their financial wellness goals. At a time of rising costs and economic uncertainty, financial well-being cannot be underestimated. It is more than paying wages; organisations can be the critical success factor in helping individuals feel secure and satisfied with their financial situation.

So, whilst fair and correct pay is essential in everyday life, financial well-being hangs on balancing present and future financial needs.

The link between financial and mental well-being

Seeking better financial initiatives can contribute significantly to an individual’s overall financial and mental wellness.

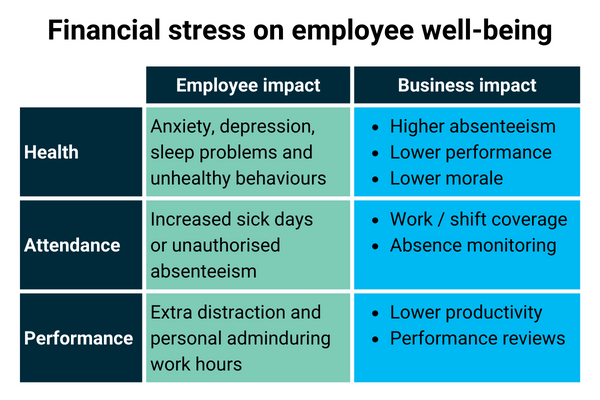

Studies have shown that financial stress can lead to anxiety, depression, and other mental health issues. When financial worries burden individuals, it affects their overall well-being and how they live. Not only is supporting financial health a moral duty but there is also a clear business case. Employees who experience money worries are more prone to absence from work and underperforming against their usual standards.

By paying attention to the impact these stressors can cause, organisations can mitigate the impact and contribute to an improved mental health outcome. Consequently, proactive UK organisations are implementing solutions to support their staff through difficult financial circumstances by pushing the boundaries of traditional payroll duties.

Epay and Work Report™

Our secure e-payslip portal, Epay, is a service that adds value to teams, the bottom line, and also an employee’s financial wellness. The recent integration of Experian’s Work Report™ into Epay automates how credit lenders validate employment information when the employee consents and needs it.

Work Report™ automates the verification of employment and income with a consumer’s consent, reducing the need for manual effort and freeing up valuable time for HR teams. In doing so, the service saves hours in securely sharing payroll data with third-party credit providers. Payroll professionals face less pressure, juggling multiple tasks within tight deadlines.

Meanwhile, the employee provides critical information at the click of a button to achieve their financial wellness goals. By quickly and securely sharing income and employment information, the system streamlines access to credit, allowing for better rates, smarter decisions, and higher acceptance rates for products and services.

Business benefits of digital transformation in payroll

Epay is an established product within the Datagraphic offering. The payslips portal processes over 1 million electronic pay documents for clients in the private and public sectors each month.

To understand the significance of this, producing digital payslips:

- Is time efficient. The TFL payroll team saves 160 days of admin time each year.

- Saves money. Epay saves money on staff processing time, printing, postage and distribution.

- Offers convenience. Users can access historical pay information whenever they need it, 24/7.

How online payslips can contribute to ESG goals

Digital payslips make financial sense for organisations. Moving to environmentally friendly technologies can contribute to our client’s environmental responsibilities and ESG goals.

Planet

- Paper reduction. Online payslips significantly reduce paper usage, which aligns with environmental sustainability goals. Epay currently saves approximately 770 trees worth of paper annually by moving away from traditional paper-based payslips, just from paper alone. Moreover, they create a lower overall carbon footprint associated with payslip production and distribution.

- Energy efficiency. Producing electronic payslips significantly reduces energy consumption compared to printed documents.

- Lower emissions. Delivery and distribution of digital documents produce lower carbon emissions compared to paper documents.

People

- Better financial wellness. Fast and accurate data sharing helps build a reliable credit history to streamline access to credit, allowing for better rates, quicker decisions, and higher product acceptance rates.

- Employee well-being. Online payslips allow users to access them conveniently and securely, promoting a more employee-friendly and efficient approach to payroll administration.

- Inclusivity and accessibility. Digital payroll documents are available to all, regardless of location or physical abilities. This promotes a more inclusive work environment and benefits individuals with thin credit files or newcomers to the UK.

Partners

-

- Compliance. Leveraging online payslips can help companies comply with labour laws and regulations, including strict GDPR principles, ensuring secure data processing.

- Data security and privacy. Ensuring robust data security and privacy measures demonstrates a commitment to good corporate governance practices. Protecting sensitive employee information contributes to building trust with stakeholders.

- Communication and transparency. Online access to payslips can enhance communication between employers and employees to foster trust and accountability, key elements of good corporate governance.

The Epay and Experian partnership supports the UN Sustainable Development Goals.

Conclusion

Good financial health empowers individuals to make choices that align with their values and aspirations. Whether starting a family or taking the next step on the property ladder, a solid financial foundation opens opportunities for a more fulfilling and purpose-driven life.

As an organisation that believes in creating a positive social impact, Datagraphic goes above and beyond to create a better client experience and offers employees innovative ways to use their data for greater financial health. The added benefits to productivity, cost-efficiency and the environment are a bonus.

Find out more about how Epay streamlines payroll tasks.