It’s important to be engaging no matter what type of correspondence you’re writing, and transactional documents are no different.

Usually containing sensitive, personal or financial information, this type of correspondence is vital to both you – the sender – and the recipient, and it’s often essential that your customers respond to it.

But what are transactional documents? Why are they important? And how do you make sure your transactional mail gets your message across effectively, engagingly, and in a way that saves you having to chase up recipients?

Here we outline our top six tips to creating winning transactional documents:

- Make it personal

- Mix up the format

- Make it engaging

- Check, check, check

- Deliver documents on time

- Make your documents accessible

But first we’ll discuss what transactional documents are, and why they’re important.

What are transactional documents?

Transactional documents are any outbound mail that completes a transaction with your customer. That means they contain financial information or personal details that need handling with care – and in line with compliance regulations such as GDPR.

Types of transactional document include:

- Service statements

- Invoices

- Payment confirmations

- Account updates

- Employment agreement changes

As with any other type of outbound mail, you can choose how to present transactional documents to your recipients. It may be more suitable to print and post them, or you may want to show them online in an accessible way.

However you choose to present your transactional documents, it’s crucial that it’s done in a way that’s secure and engaging for your recipient, and that it enables the customer to complete any required tasks on time and with ease.

Why are transactional documents important?

Transactional documents include critical financial information that’s essential for your customers to carry on with their work or update their finances, so it’s a vital piece of correspondence for business operations.

Due to the nature of transactional documents, 95% of recipients open them and interact with them (compared to just 10% of direct marketing mail). That makes them a great resource and communication channel – not just for providing essential financial information, but for reaching out to your customers in other ways, including:

- Marketing

- Online surveys

- Discounts for repeat purchases

So there’s scope to use them to enhance your customers’ experience.

And because you’re sending each transactional document to an individual, it’s possible to personalise and tailor transactional mail for each customer, which can result in increased engagement and improved response.

95% of recipients open transactional documents and interact with them, compared to just 10% of direct marketing mail.

6 expert tips for handling transactional documents

When it comes to crafting winning transactional documents, there are some essential steps to follow.

Here, we outline our top six.

Step one: Make it personal

While transactional documents typically contain essential data, your reader must engage with the information, and that means including more than just crucial data like transaction details.

Making transactional documents personal – and tailoring your message – can increase the likelihood of your customer responding.

For example, if the statement you’re sending shows an overdue payment, you could include a message that offers guidance around helping with late payments to encourage a response.

Aceni, our multichannel communication system, enables you to personalise your mail, tailoring it for your recipient – and it can automate your processes too, saving you time and resources.

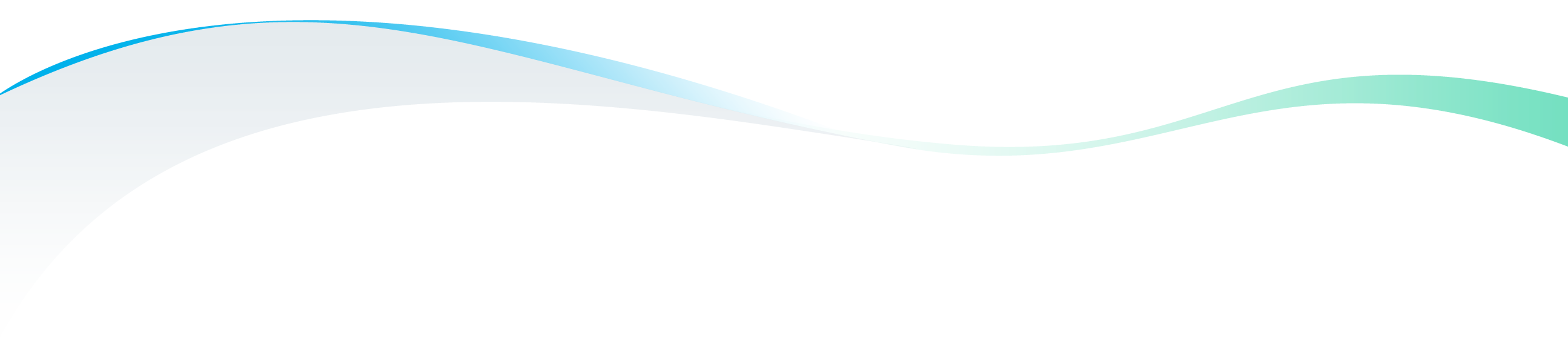

Step two: Mix up the format

Whether you’re sending transactional documents by post or presenting them digitally by a secure web-page or online document portal, your recipients will engage more with a functional, well-designed document. So it’s important to think about how the document looks, as well as the information it contains.

Craft a user-friendly document by:

- Including appropriate images

- Improving the layout: making sure the content flows in a logical order

- Drawing attention to certain words or the call to action

Images can help make your transactional documents more engaging and encourage the recipient to respond. That’s because people receive 105,000 messages on average each day, so making yours stand out will help make it memorable and encourage your recipient to respond.

This is also a great way to use the white space typically found in transactional documents. Be careful, though, not to make it too busy, or it will be overwhelming, off-putting, and the vital information you want to communicate could get lost.

Using Aceni, you can personalise your transactional mail, presenting content and images that are most appropriate to each of your customers.

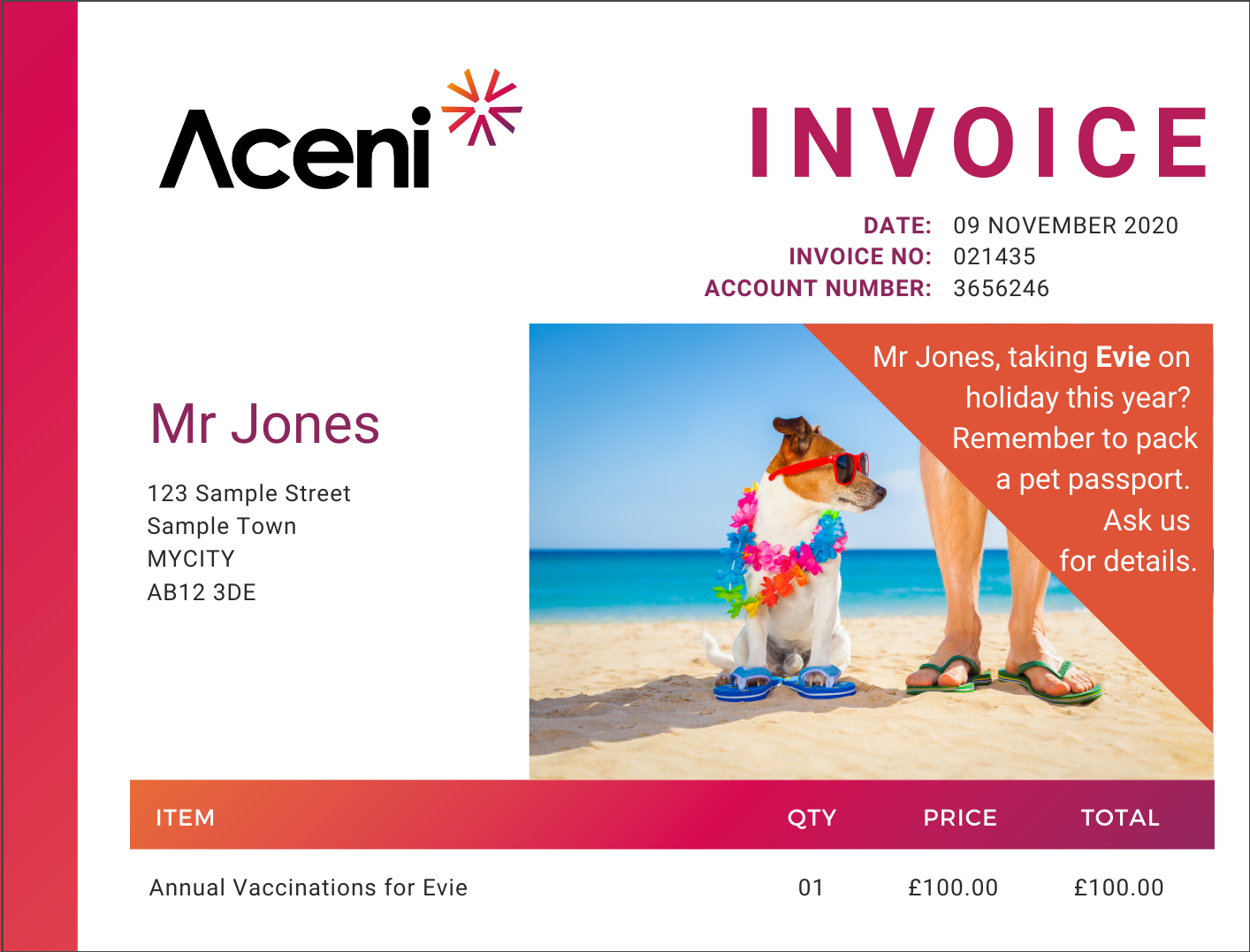

Step three: Make it engaging

Black and white documents are functional, but they can harm your recipients’ ability to process and store the information you present to them. It’s estimated that between 62% and 90% of judgements are made as a direct result of colour, so it’s worth injecting some into your transactional documents.

Not only will it help make sure your documents are read, it will help your customers retain what they read. Plus, colour is a strong mood-changer. So by moving away from functional black and white and into colour, not only will you be encouraging your customers to interact with the transactional document, you’ll encourage them to respond where necessary too.

Having said that, don’t be tempted to overdo it. Something as simple as adding colour to your logo could be enough – in fact, studies have shown that leveraging the colours in a company logo can increase brand recognition by up to 80%.

Step four: Check, check, check

Transactional documents invariably include sensitive, financial information that’s usually personal to the recipient. So it’s essential that you do everything possible to make sure the data is accurate and that the right information is sent to the right person.

Data protection has always been important, but it has become even more essential since the introduction of the GDPR. So always take time to double and triple-check that all the information contained within the transactional document – as well as aspects like the address and recipient name – is correct before you send it.

By using Aceni, you can set rules to automatically stop (suppress) mail before it’s sent, holding any documents with missing information so that they can be fully checked and approved before being sent out. You can also track your documents, giving you an audit trail that fully supports your compliance needs.

Plus, with Aceni your transactional documents mail through systems that scan your mailing packs for accuracy at the point of closing the envelope. So, you get clear, accurate communications with reduced service errors thanks to the system’s document content controls.

Step five: Deliver documents on time

Transactional documents must arrive on time. That’s because they often contain essential information that your recipient needs for their records or you need in terms of payment.

Your recipients may require this information to carry on with their business, or to keep track of expenses and other financial aspects of their work. As a result, late documents can negatively impact your cashflow or customer experience, and there are often penalties involved if anticipated content doesn’t arrive when expected.

Whether you’re printing and posting transactional documents or presenting it digitally, Aceni can help deliver your documents on time by:

- Automating the production and delivery of your communications

- Prioritising urgent documents as needed

- Enabling you to undertake same-day processing

All this means you can get key items of transactional mail out quickly.

And if you need to post documents? Aceni can reduce your distribution costs by consolidating statements and batching invoices so that they can be sent to the same customer at the same time. As well as saving time for you and your customer, it also reduces postage costs as each transactional document can be posted in one envelope.

Step six: Make your documents accessible

Knowing your audience is a key part of any communications strategy. More than 36,000 people in the UK are blind or partially sighted, which means that 1 in 30 people will struggle to read the communications you send them. It’s therefore vital that any transactional mail you send is accessible for every recipient.

Offering your customers a choice as to how they read important transactional documents – including Braille or larger page size documents – enables you to reach each recipient effectively and makes sure that the financial information they need can be accessed easily.

Not only does it mean that more of your recipients will be able to read and engage with the document, but it also improves response rates as the number of accessible channels will be increased.

Whether your recipients want to receive information in print or online, by using Aceni, you can add notification flags to the data, and the automation solution will split it accordingly, meaning multichannel, transactional communication – for all your customers – is simple and straightforward.

Bonus tip: Use the space

We couldn’t keep it to just six tips, so here’s an extra one!

Transactional documents play an increasingly important role in digital customer journeys. That’s because, when people engage with physical transactional mail, they read and retain it.

As a result, transactional documents give you a great opportunity to reduce the need for standalone direct marketing communications, as you can use any excess space to include adverts or further information for your recipient, such as inviting them to do more online.

For example, you could include QR codes or personalised URLs that your recipients can scan or click on to make a payment online. This makes the process quick and easy for them and improves their experience – and means faster payment for you too.

You could go further too, and include links to online surveys or forms that allow your customers to quickly and easily update their information in your system. This often reduces the need to contact you directly, saving the customer time and reducing demand on your customer service teams.

This is a simple change that can help deliver a richer, more interactive communication experience that’s more likely to be engaging and positive for your customer.

Round-up

Transactional documents are key when it comes to communicating important financial information to your customers.

They’re a vital part of your business’s processes, enabling your customers to receive, retain and respond to the information they need, and enabling you to receive and process payments efficiently.

Despite being functional, transactional documents are a gateway to capturing your recipients’ attention. They can be used as a platform for transactions other than the purely financial – such as updating account details or providing marketing messages that could be beneficial to your recipients.

Creating winning transactional documents is simple: just follow the six steps we’ve covered:

- Make it personal

- Mix up the format

- Make it engaging

- Check, check, check

- Deliver documents on time

- Make your documents accessible

Using Aceni from Datagraphic can help you achieve these steps in a simple, straightforward way that saves you time, money and resources.

Our team can work with you to help send out transactional documents which are more accurate, traceable and personalised in no time – and all through an automated process.

Find out more about how Aceni works and how it can benefit you, and get in touch to start producing winning transactional documents.