Electronic payslips – also known as online payslips and epayslips – are the most common way for employees to receive their payslips. Here we share the key benefits of delivering electronic payslips for payroll teams still yet to make the switch.

Traditionally, employees would receive a paper payslip on a weekly or monthly basis, and many still do. However, as technology has evolved and influenced how we communicate, payroll teams have met changing employee expectations. Electronic payslips are now very often the standard rather than the exception.

The latest CIPP payslip distribution report found 60% of organisations provide electronic payslips via an online self-service facility (with a further 32% using email, but we’ll come back to that in a moment). The distribution of payslips has seen a significant shift since the CIPP first began its research in 2008, where only 12% used an online self-service facility.

60% of organisations provide electronic payslips via an online self-service facility¹

Only a decade ago, electronic payslips were considered a privilege for the select few, offered mainly to office-based employees who had access to a company computer. This made the business case for electronic payslips difficult to justify, as payroll teams wrestled with balancing the cost-benefit: between set-up costs and employee opt-in rates.

But, as technology has advanced, so too have employee expectations. We now see an increasingly digital workforce that wants to receive communications in different ways.

Different ways to deliver electronic payslips

There are many different ways to deliver electronic payslips, for example:

- Company intranet

- Email

- Attachment

- Embedded

- Weblink

- Mobile app

- Online portal (mobile-optimised)

They all have their advantages and disadvantages, but the main differences between these options are accessibility, security and availability.

Whichever way you decide to choose to deliver electronic payslips, please make sure it’s secure! We can’t emphasise this enough. Payslips contain financial and sensitive information that is personal to each employee, and it’s your responsibility to minimise opportunities for personal employee data to be seen by the wrong people or have an impact on someone’s privacy (do we even need to mention the GDPR?!).

This is why it’s still surprising to see that 32% of organisations are emailing payslips to employees, as inherently, this isn’t considered a secure communication method. We’ve written a popular article on this, 6 things you should know before emailing payslips, which we recommend you read before considering email as an option.

So why should you deliver electronic payslips?

As mentioned earlier, payroll teams once found it difficult to justify the cost-benefit of delivering electronic payslips so continued to provide paper payslips. The main concern was that not all employees would want to receive an electronic payslip, so the struggle for payroll teams would be managing two different processes: printing paper payslips for the many and hosting online payslips for the few.

But, this shouldn’t be a concern anymore. Employees now expect the documents you send to be available online (just like they would expect to receive online statements from a bank). Also switching to electronic payslips doesn’t mean you have to deliver 100% online. It’s important not to forget about your employees’ preferences. Our motto at Datagraphic is to think ‘digital-first’, not ‘digitally-exclusive’.

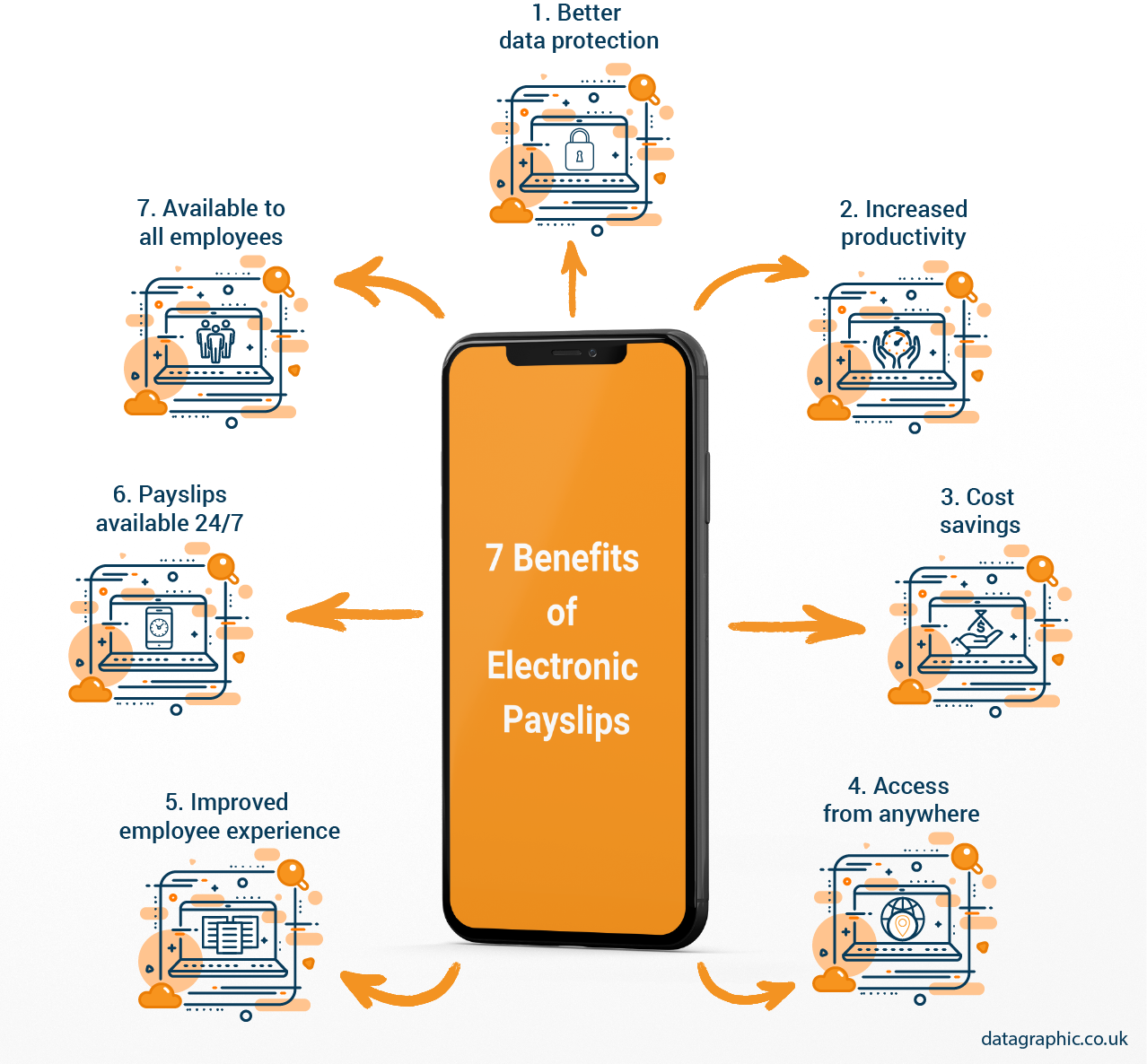

Electronic payslips provide a wealth of benefits for payroll teams and employees.

Here we share our seven key benefits of electronic payslips:

- Better data protection: employee data is secure

- Increased productivity: reduce time spent on manual processes

- Cost savings: reduce spend on postage

- Access from anywhere: remote access for payroll teams

- Improved employee experience: all documents in one place

- Payslips available 24/7: anytime, anywhere from any connected device

- Available to all employees: temporary workers, office staff, remote staff, students and pensioners

Let’s take a look at these benefits in more detail.

1. Better data protection: employee data is secure

Paper payslips are often printed and posted to home addresses or manually distributed to employees in offices, stores and depots. There is an element of vulnerability in this delivery method because payslips can get lost, misplaced or distributed to the wrong person.

Electronic payslips provide better data protection because secure solutions require employees to enter information unique to them, such as usernames and passwords and security questions. This is why we don’t consider email a secure delivery method because emails can also get lost in transit.

The security and protection of employee data is vital. Does the electronic payslip solution you’re using, or considering, offer extra data protection such as a two-level login process, two-factor authentication and strict administrator access?

2. Increased productivity: reduce time spent on manual processes

Electronic payslips can cut the time you spend on manual and repetitive employee document processes by 98%. The time you’ll be free to use on other important tasks.

H&M save 156 days of administration time a year by delivering electronic payslips instead of paper payslips

Before working with Datagraphic, it took fashion retailer H&M five hours per week in-house to print payslips to their 9,000 employees. Each payroll team member spent a further three hours separating the multi-part payslips and preparing them for despatch. By delivering electronic payslips – using Datagraphic’s payslip portal solution, Epay – they were able to save 156 days of administration time a year. You can read their full success story here.

3. Cost savings: reduce spending on postage

Before introducing Datagraphic’s electronic payslip solution – Epay – the world’s largest services company, Sodexo, used to deliver paper payslips to their UK workforce. The large volume of weekly and monthly paid employees meant providing paper payslips was very costly for Sodexo due to high printing costs and rising postage rates. The payroll team found it very difficult to produce annual budgets as they didn’t know when Royal Mail would increase their postage rates and by how much. After switching to online payslips, Sodexo achieved a rapid return on investment and saved £160,000. Read the full case study here.

Sodexo save £160,000 annually after switching to electronic payslips

Typically, the preparation and mailing of a paper payslip can cost over £1 per payslip. But we’ve seen payroll teams reduce that cost by over 80% when delivering an electronic payslip. Therefore the cost-saving over a year is substantial. Good electronic payslip solutions use a simple pricing structure, where you pay for the documents you upload, not the number of employees you have (so no employee licence fees!).

4. Access from anywhere: remote access for payroll teams

There are electronic payslip solutions that allow you and your teams to upload pay data to a secure online portal from anywhere. All you need is a device with an internet connection, giving you a more efficient, flexible and agile way of working.

This continues to be an important benefit for payroll teams as most of the UK workforce is still being asked to work from home, where possible. And the need for remote access to payroll software and services is crucial for payroll teams to meet compliance deadlines.

By providing electronic payslips, no matter where you or your employees are based, you can easily and quickly send payslips on or before payday.

5. Improved employee experience: all documents in one place

How many phone calls does your payroll team get asking for copies of payslips? Paper payslips require employees to keep and store copies in a safe place, but they get misplaced more often than not.

Using a secure online portal to deliver electronic payslips means employees no longer have to worry about finding an old payslip, as all past and current documents are hosted online in one secure place.

So that’s one less problem for the employee and one less phone call for your team.

Plus, online portal solutions allow you to provide one secure place for past and current payslips and other employee documents. For example:

- P60s

- P45s

- P11Ds

- Reward statements

- Company policy documents

- Timesheets

6. Payslips available 24/7: anytime, anywhere from any connected device

We live in an always-connected world, where we expect information to be at our fingertips in seconds. Employees’ expectations have changed; they want to receive the same consumer-grade experiences from their employers too. They want to access their employee information, including payslips, wherever they are: at work, home or on the go. Not only that, but they also want the information to be available to them at any time of the day too.

Delivering electronic payslips means employees can view their pay information anytime, anywhere, from any connected device. That’s why the electronic payslip solution you choose must have 24/7 availability from any internet-connected device.

7. Available to all employees: temporary workers, office staff, remote staff, students and pensioners

Electronic payslips can be accessed at home, at work or on the go so that you can deliver digital documents to everyone. All they need is a device that is connected to the internet.

To get employee buy-in, you need to be digitally inclusive. Make sure the electronic payslip solution you choose can easily deliver electronic payslips to all your employees and not just those with a company email address or access to your company intranet. This should include temporary workers, remote staff, students and pensioners.

Whilst many employees will prefer the digital experience of receiving electronic payslips, a percentage of your workforce will still need printed documents. But don’t worry. There are solutions available that provide multi-channel payslip delivery. All you need to do is provide one set of payroll data, and then the solution can automatically check who needs to print and they deliver it.

Whether you’re considering using your payroll software or a third-party provider to deliver electronic payslips, make sure they deliver a service that provides the seven key benefits we’ve covered as a minimum:

- Better data protection: employee data is secure

- Increased productivity: reduce time spent on manual processes

- Cost savings: reduce spending on postage

- Access from anywhere: remote access for payroll teams

- Improved employee experience: all documents in one place

- Payslips available 24/7: anytime, anywhere from any connected device

- Available to all employees: temporary workers, office staff, remote staff, students and pensioners

Datagraphic’s Epay – a secure electronic payslip portal – delivers all the key benefits mentioned above and more. Epay offers employees quick and easy access to their pay information from any device, any location and at any time. What’s more, with the option to automate the printing of documents for employees that can’t access them online, Epay brings with it an unrivalled multi-channel experience for everyone.

Plus, Epay works with data from your current systems: no lengthy software change projects and no capital costs. So you can be live in weeks and enjoy Epay’s many features and benefits.

If you’d like to learn more about delivering electronic payslips, then speak to one of our experts, who will be more than happy to talk through options that suit your needs.

References

-

CIPP Payslip Statistics Comparison 2008 – 2019, The Chartered Institute for Payroll Professionals